Who will be the last author to write about the great mistake that was the Trump presidency? Maybe no one, and certainly not anytime soon. Should state governments serve plutocratic elites or their own citizens? A growing number are making the wrong choice. Now this IPS report shows just how many states are signing up to be the haven of illicit money and harbor the ultrawealthy from paying their taxes. Grumbach, Laboratories Against Democracy: How National Parties Transformed State Politics, argues that the states have become “the wrecking ball” of democracy, subverting the desires of their citizens and throwing roadblocks in the way of their right to seek redress with their vote.

It also leads to more social breakdown and polarization as our collective capacity to solve big problems-like responding to a pandemic or ecological disruption-is rendered inoperative.Īt The New Republic, we’ve found ourselves asking more and more: Are states OK? A recent book by Jacob M.

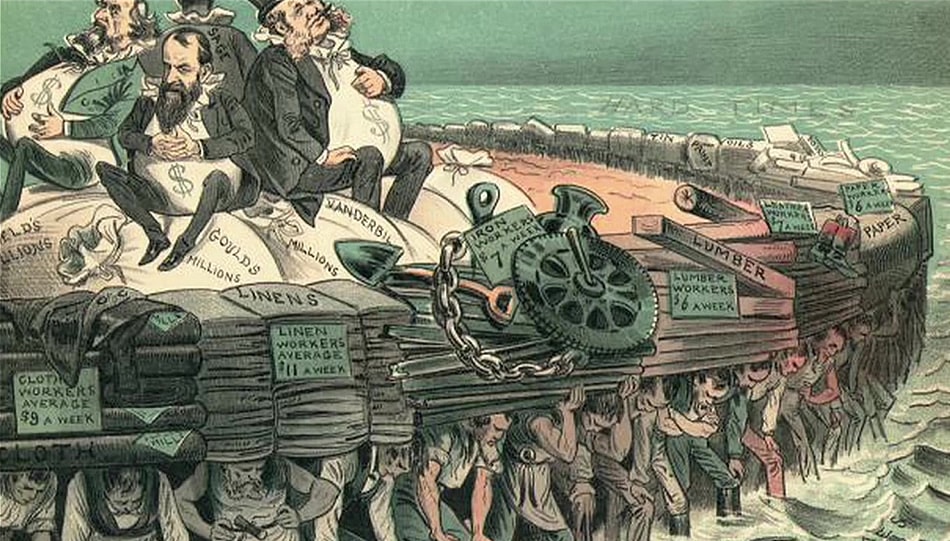

This leads to further consolidation of wealth dynasties, impervious to taxation and accountability. They block popular reforms by capturing the political system and ensuring dysfunctional gridlock. The wealthy deploy their power to further shape the rules, news, and culture of society, including trust law. They also note that there “is a significant correlation between regressive state taxation systems, which hurt the poorest residents, and trust-subservient state laws.” But the worst effect by far is the way this misrule further entrenches inequality of all stripes: As Thomhave and Collins report, ordinary people don’t derive any material benefit from their states transforming themselves into safe-deposit boxes for oligarchs. This corrupted regulatory state impacts our lives in numerous ways. And the Pandora Papers revealed that there is a small army of stateside lawyers ready to come to the aid of those who need to keep their filthy lucre hidden.Īnd as the IPS’s Kalena Thomhave and Chuck Collins note at length, the deterioration of the laws governing trusts have many ill effects on ordinary people, from the way “investments by anonymous trusts in real estate” help to “push up the cost of housing for locals” to the democracy-debasing effect of permitting foreign oligarchs and like-minded thieves to stash their plunder here in the U.S. There’s a sizable amount of corrupt money flowing through America’s think tanks as well. As TNR contributor Casey Michel has noted, the top grifters in the kleptocracy extended universe aren’t just parking their loot in popular Western capitals, they’re buying up real estate in Cleveland -where Ukrainian kleptocrat Ihor Kolomoisky was, at one point, “the largest commercial real estate holder” in the city. is growing in stature as one of the premier locations for oligarchs of all stripes to safely stash their cash. If there’s one thing that we’ve learned from recent disclosures-such as the Pandora Papers-on the lengths that the rich and powerful will go to stash their wealth, it’s that the most innovative and disruptive tax havens in the world are the ones right next door. The truth, however, is that havens for illicit and ill-gotten boodle aren’t nearly as exotic as the Robert Ludlum novel in your mind. What do you think of when you think of tax havens? For many, the idea evokes Swiss banks or Caribbean islands-far-flung locales where shell companies stack high and shady enablers in fine suits ooze around every street corner.

0 kommentar(er)

0 kommentar(er)